Scalability vs. Agility: A Deep Dive into Islamic Banking Income

Analyzing the quarterly income from Islamic banking operations across Malaysia’s top players reveals a fascinating split in operational strategy. Using data from charts.bursavisuals.com, we can categorize these institutions into three distinct profiles.

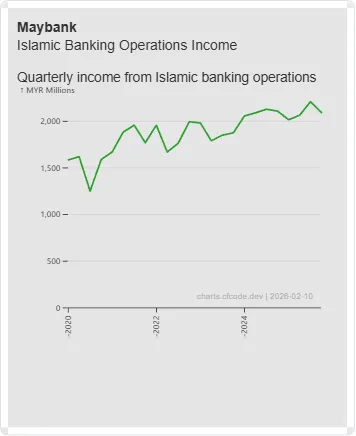

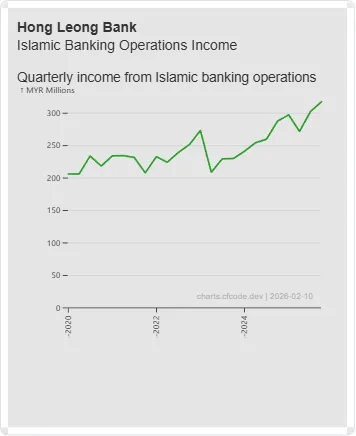

The Scale Leaders (The Giants) Maybank remains the primary “Engine” of the industry. Its income levels are in a different league, staying consistently above RM1,500 million and recently peaking over RM2,000 million. Similarly, Hong Leong Bank represents the “Armor” of the sector—its growth is incredibly linear and disciplined, showing a steady rise with almost no quarterly “noise”.

Maybank

Hong Leong Bank

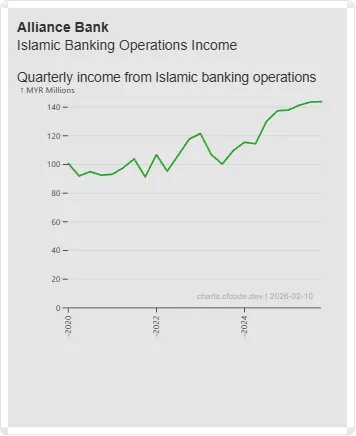

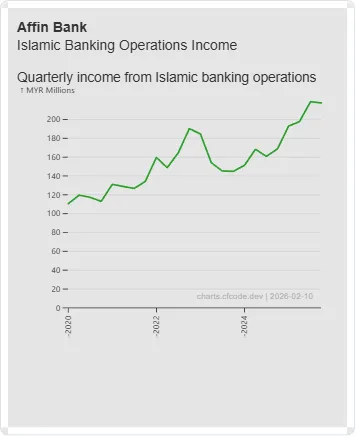

The Aggressive Challengers (The Sprinters)

Alliance Bank and Affin Bank represent pure agility. While their total income is lower in absolute terms (between RM140M and RM220M), their growth trajectories are much steeper than the larger banks. They are successfully carving out a niche, likely by being more aggressive in their Shariah-compliant financing offerings.

Alliance Bank

Affin Bank

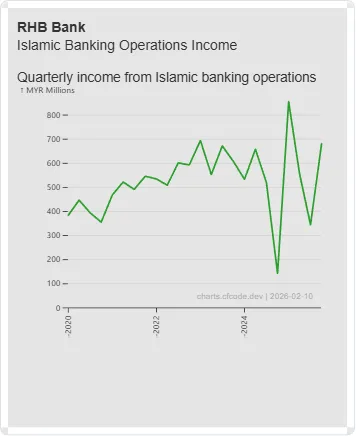

Managing Volatility The most striking data point comes from RHB Bank. Unlike the steady climb of its peers, RHB experienced a massive “V-shaped” volatility event between 2024 and 2025. This type of movement often points to the completion or exit of large-scale corporate financing projects. It highlights the difference between banks that rely on steady retail deposits versus those with lumpy corporate income streams.

RHB Bank

Which strategy do you believe is more sustainable in a this interest-rate environment: steady retail growth or high-value corporate spikes?

Subscribe for my RSS feed or follow me on socials for more charts, insights and stories.

#IslamicFinance #MalaysiaBanking #FinancialAnalysis #DataVisualization #BursaInsights #EconomyMalaysia #BankingStrategy #AffinBank #Maybank #HongLeongBank #AllianceBank #AmBank #RHBBank