Scalability vs. Agility (2020–2026)

Between January 2020 and February 2026, the Malaysian banking sector has proven to be an engine of growth. Every chart in the latest dataset reveals a consistent upward trend in Gross Total Loans Outstanding, but the strategy behind that growth varies.

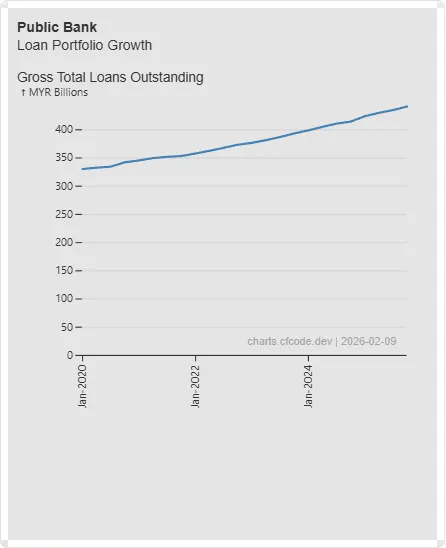

Public Bank

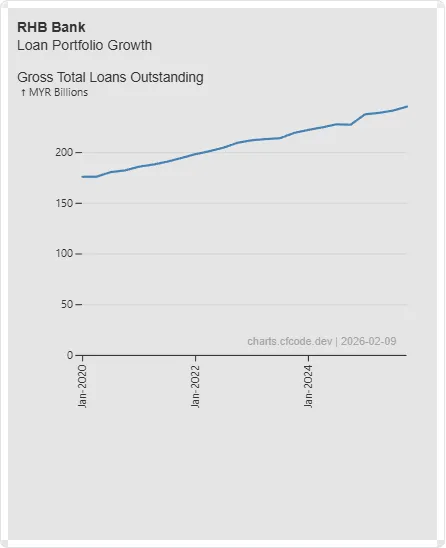

RHB Bank

The Power of Scale Public Bank and RHB Bank demonstrate the resilience of the market incumbents. Public Bank’s journey from MYR 330 Billion to MYR 400 Billion+ proves that even the largest portfolios can maintain steady expansion. RHB’s climb toward MYR 250 Billion mirrors this, showing a disciplined, linear accumulation of assets.

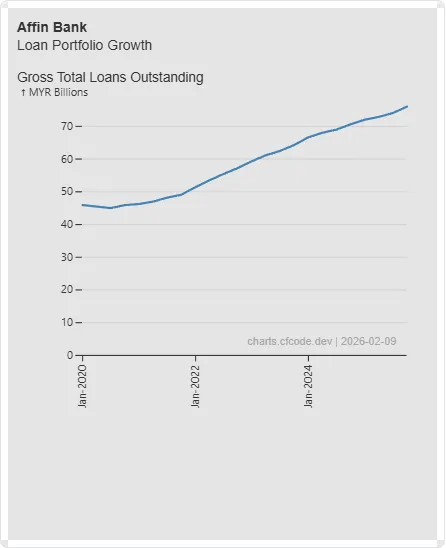

Affin Bank

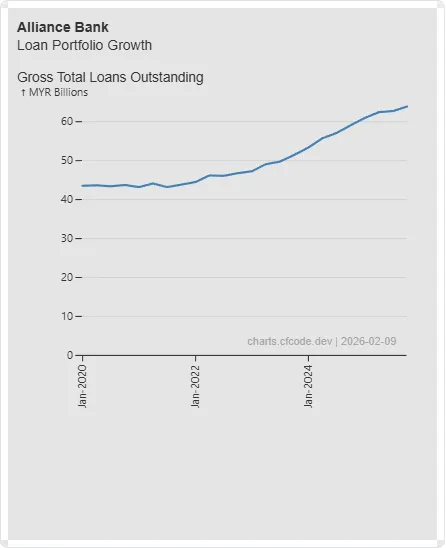

Alliance Bank

The Rise of the Challengers For those seeking momentum, Affin Bank and Alliance Bank are the primary focus. Their trajectories are significantly steeper than their larger peers, with Affin scaling to ~MYR 75 Billion and Alliance moving from MYR 43 Billion to over MYR 60 Billion. This suggests a high-efficiency model aimed at capturing market share quickly.

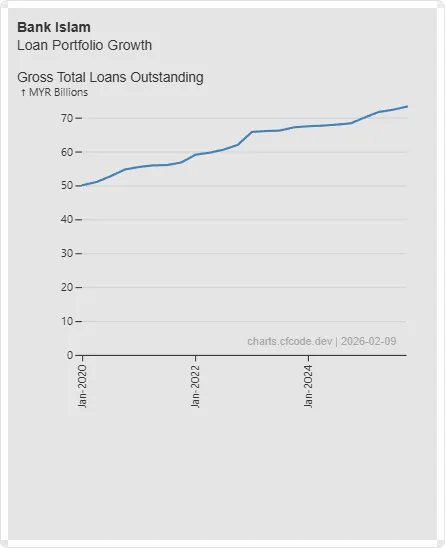

Bank Islam

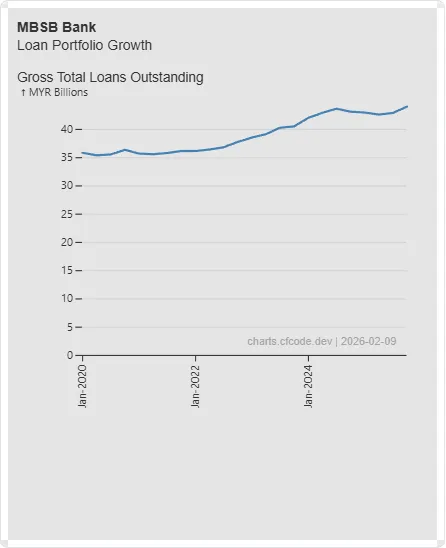

MBSB

The Islamic Momentum Bank Islam and MBSB continue to reflect the structural shift toward Islamic finance. Bank Islam’s rise to over MYR 70 Billion and MBSB’s move past MYR 40 Billion highlight a persistent, healthy demand for Shariah-compliant products.

The Banker’s View From a banking perspective, there are two paths: the Fortress (Scale) and the Engine (Growth). Both have seen uninterrupted success over the last 6 years. The question for the market is whether the Challengers can maintain their steep growth curves without sacrificing the stability found in the larger incumbents.

Subscribe for my RSS feed or follow me on socials for more charts, insights and stories.

#BankingIndustry #AssetManagement #FinancialAnalysis #EconomicGrowth #MalaysianBusiness #Fintech #IslamicBanking #InvestmentStrategy